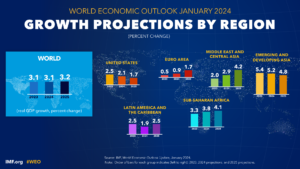

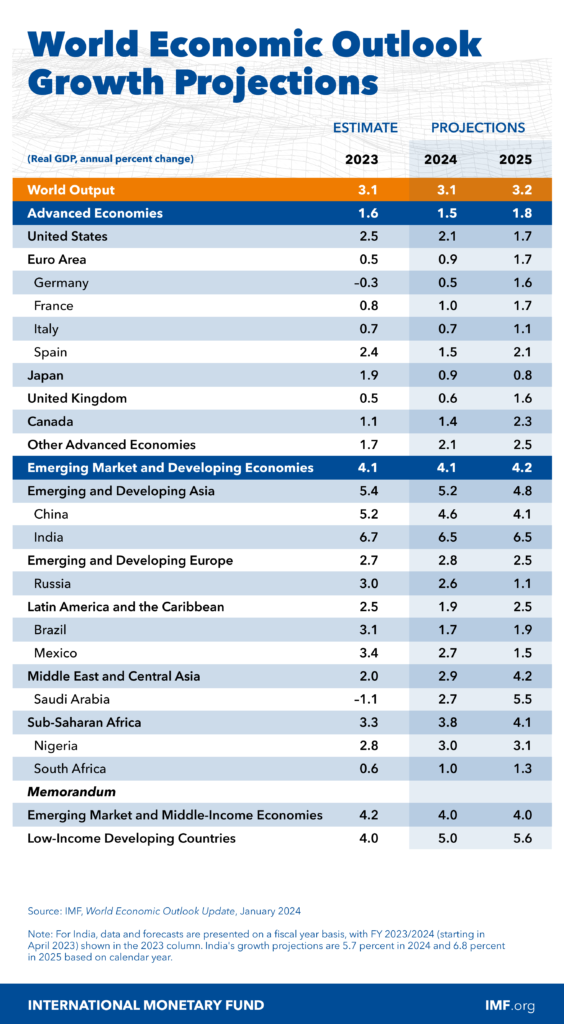

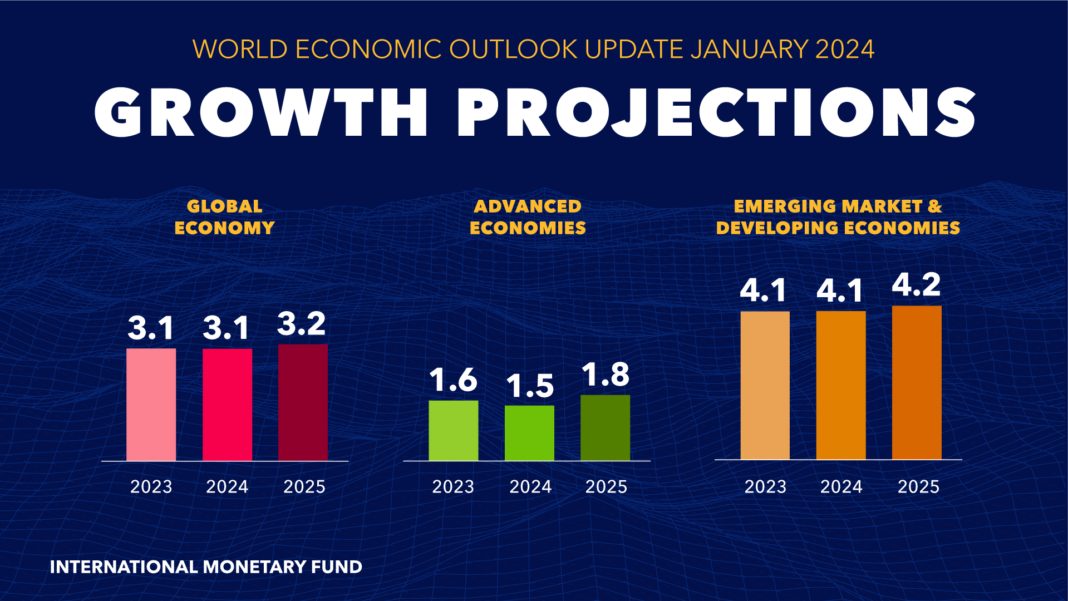

The International Monetary Fund (IMF) recently released its World Economic Outlook update for July 2024, revealing a steady global growth rate of 3.2% for the year. This figure remains unchanged from the April forecast, with a slight uptick to 3.3% expected next year. The report highlights key developments in major economies, noting that while growth is becoming more synchronized across advanced economies, significant challenges persist that could impact future stability.

The IMF report underscores a nuanced landscape where economic growth varies significantly by region. In the United States, signs of economic cooling are becoming more apparent, reflecting a gradual slowdown. Conversely, the Euro area is witnessing a modest resurgence, driven by closing output gaps and supportive fiscal policies. Asia’s emerging markets, particularly India and China, continue to act as the primary engines of global economic growth. Both countries have seen upward revisions in their growth forecasts, collectively accounting for nearly half of the global increase.

Despite these positive signs, the IMF cautions that China’s growth is expected to moderate to 3.3% by 2029, a notable decrease from its current pace. This deceleration is attributed to structural changes in the Chinese economy, including efforts to shift from investment-led to consumption-driven growth, as well as demographic challenges such as an aging population.

Global inflation trends present a mixed picture. The IMF projects a decline in global inflation to 5.9% this year, down from 6.7% in 2023, indicating progress towards stabilization. However, the path to achieving target inflation rates remains fraught with challenges. In advanced economies, particularly the United States, the disinflation process has slowed, raising concerns about potential bumps on the road ahead.

Pierre-Olivier Gourinchas, the IMF’s Chief Economist, emphasized the importance of vigilant monetary policy. Central banks, including the Federal Reserve, may need to maintain higher borrowing costs for an extended period to manage inflationary pressures. This approach, while necessary, could pose risks to overall growth and exert upward pressure on the US dollar, impacting emerging and developing economies.

The report also highlights significant fiscal challenges facing many countries. Public finances have deteriorated more than anticipated due to the COVID-19 pandemic, leaving nations vulnerable to future economic shocks. The IMF advocates for credible and gradual rebuilding of fiscal buffers to address emerging spending needs, such as climate change adaptation and national security.

Additionally, the gradual dismantling of the multilateral trading system poses a threat to global economic stability. The rise of protectionist policies and unilateral trade measures could distort trade flows, weaken growth, and hinder coordinated efforts to tackle global challenges. The IMF stresses the need for renewed multilateral cooperation to ensure a prosperous global economy for all.

while the global economy shows resilience with steady growth rates, it faces a complex array of challenges. Effective monetary and fiscal policies, alongside enhanced international cooperation, are crucial for sustaining economic stability and addressing the pressing issues of inflation, fiscal health, and trade dynamics.